2024 Business Use Of Home Exemption – She started her career writing and editing content about home Owning a business and managing a workforce come with paperwork and compliance. One such law, outlined by the U.S. Department of Labor . Add all of your exemptions to determine your total number of exemptions. Use the following example for and John’s 5-year-old daughter live in the Doe home; Jane and John are both unemployed .

2024 Business Use Of Home Exemption

Source : www.rankincounty.orgSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comBeneficial Ownership Information Reporting | FinCEN.gov

Source : www.fincen.govRMS ACCOUNTING | Fort Lauderdale FL

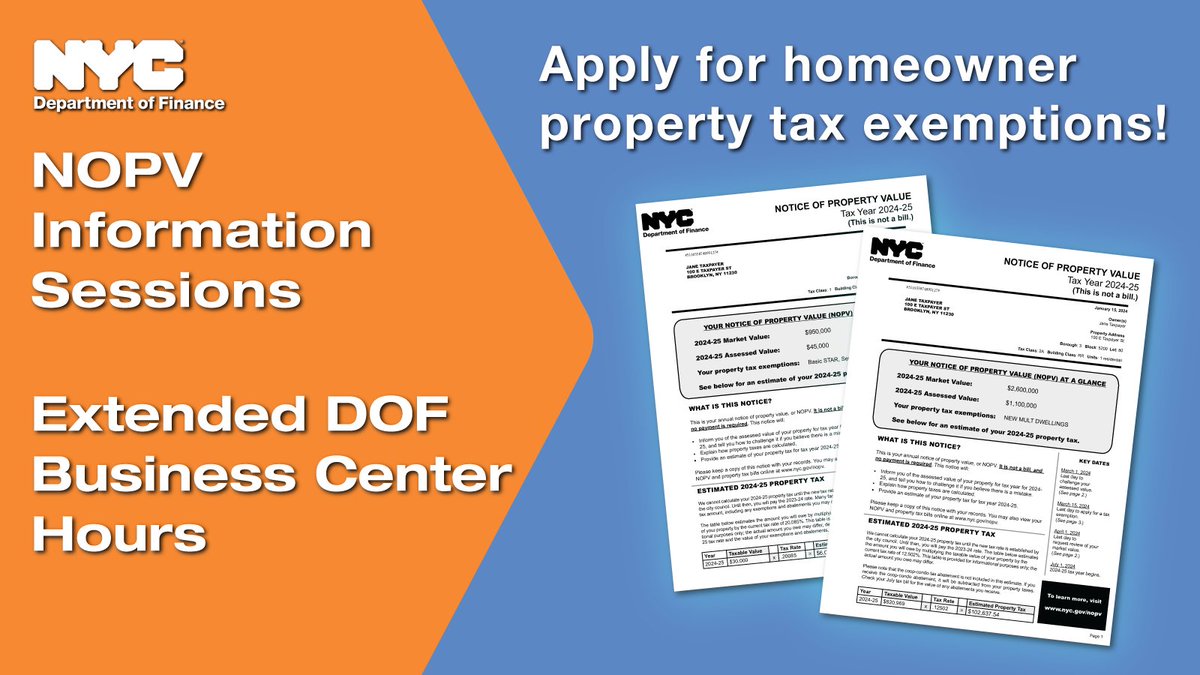

Source : www.facebook.comNYC Finance (@NYCFinance) / X

Source : twitter.comM & M Bookkeeping, Tax, and Business Services | Bristol TN

Source : www.facebook.com2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.orgTop Business Solutions LLC

Source : m.facebook.com25 Small Business Tax Deductions To Know in 2024

Source : www.freshbooks.comJacqueline Kasai Broker Associate

Source : www.facebook.com2024 Business Use Of Home Exemption Home / Rankin County, Mississippi: States that have granted Purdue University exemption from their sales tax have provided the following certificates or rules for use while purchasing within their borders. When using an exemption . A wholesaler, however, who is in business to make a profit may claim an exemption from sales-and-use tax on merchandise purchased for resale. Sales-tax exemptions for wholesalers are handled at .

]]>